The 25-Second Trick For Life Insurance

Table of ContentsHow Life Insurance can Save You Time, Stress, and Money.The 6-Second Trick For Life InsuranceGetting My Life Insurance To WorkGet This Report about Life InsuranceLife Insurance Things To Know Before You Get ThisExcitement About Life InsuranceSee This Report about Life InsuranceFacts About Life Insurance Revealed

Life insurance coverage is there to assist take some of the economic problem off your liked ones when you pass. It does not take long to discover a life insurance policy that will certainly meet your needs as well as assist your family members when they need it most.

The Buzz on Life Insurance

Premiums and other plan qualities can differ by many elements including the quantity of protection you require, as well as your age and also wellness. If death takes place while the insurance coverage is active, your beneficiaries can submit a case to get the payment.

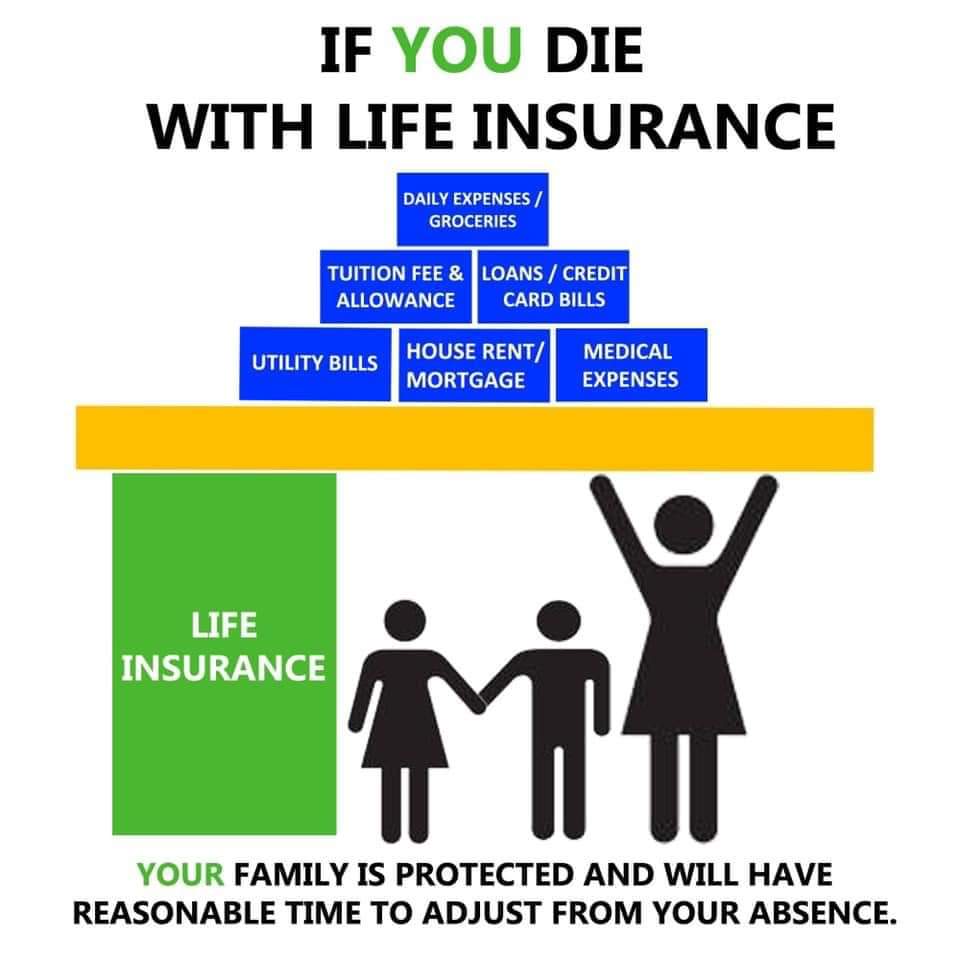

"We commonly recommend individuals aim for 10 to 15 times their earnings in life insurance coverage," claims Nicholas Mancuso, senior operations supervisor of Policygenius' sophisticated preparation team. This amount ensures your beneficiaries are covered for the long-term. Because a life insurance policy advantage is a tax-free round figure of money, your household can use the cash money nonetheless they want, consisting of: Housing expenses, consisting of repaying a home mortgage or paying lease, Various other debts, like trainee loans, bank card or cars and truck repayments, Existing or future college education and learning costs for your youngsters, Child care Replacing financial assistance you gave, Day-to-day expenses consisting of food, transport as well as healthcare, Vacation There are several kinds of life insurance coverage, but term life insurance policy is the best selection for most individuals due to the fact that it is the most inexpensive.

The Only Guide for Life Insurance

The advantages of a term life plan include: The most inexpensive life insurance policy you can acquire. If you buy term life insurance policy when you remain in your 20s, 30s, or 40s, you can secure low rates.Term life insurance policy is purely an insurance policy product and does not have a financial savings or financial investment component. This is an advantage investing and conserving on your own returns higher returns.

The most noticeable advantage of life insurance is the tax-free cash payout for your loved ones if you pass away. Financial protection is the most important possession life insurance policy offers you and your family. Yet there are other major advantages, depending on the sort of life insurance policy plan you acquire as well as which extra cyclists you select.

The 8-Minute Rule for Life Insurance

What are the benefits and drawbacks of life insurance policy? The greatest benefit of life insurance coverage Recommended Site is financial defense for your loved ones if you pass away. However, you do need to pay regular monthly premiums for this satisfaction, which can be costly if you're in bad health and wellness or buying insurance try these out coverage when you're older.

This write-up has to do with boosting understanding regarding the value of additional info getting life insurance in the post-covid-19 pandemic period. Following are some factors that will assist you get the value of life insurance policy: Individuals have become a lot more familiar with their health condition and also have actually become aware life insurance coverage importance as well as advantages.

What Does Life Insurance Mean?

Have you believed of investing your hard-earned cash as well as letting it grow as well as guaranteeing your household at the exact same time? Having invested in a life insurance coverage plan gives you with dual chances of guaranteeing your family members and spending your cash in the market in shares, bonds, stocks, and so on.

One of the most essential elements of life insurance policy value is that it supplies a financial roofing system on your household in situation of any unfavorable incident as well as uncertain times, such as the death of the family's breadwinner. In such situations, you wouldn't have to stress if your family will deal with any financial constraints in your absence.

The 25-Second Trick For Life Insurance

In situation of an unfortunate occasion of fatality of the financier, their family will obtain a lump sum amount of cash in the kind of survivor benefit. As an outcome, even if you are the sole income producer of your family members, you would not have to fret about your family members's economic demands.

One more function that contributes to the relevance of life insurance coverage tax obligation advantages. Under area 80C of the Earnings Tax Act, 1961, the costs paid by the financier are qualified for tax advantages up to Rs. 1. 5 lakhs each year. tax obligation regulations undergo change periodically.

The Buzz on Life Insurance

Allow me share a story with you. A number of years earlier, at our yearly business reception, we had a visitor speaker. life insurance. She was a customer of Finity Group (and still is today). She was there to inform her story to everyone in presence. She and her hubby were both physicians in residency, ready to graduate and also get in method a couple of months later on.

The Basic Principles Of Life Insurance

She had not been even sure just how she was going to obtain with her pregnancy, let alone bring on with life as a solitary mom. Obviously having life insurance coverage would not have brought her husband back, but it would certainly have minimized some of the monetary stresses she encountered throughout that time.